Modifiers in mind map

Rate modifiers are used to adjust a policy's premium based on a set of risk characteristics, as described in Rate modifiers.

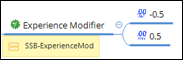

Unscheduled rate modifier

A rate modifier that does not have multiple rate factors is called an unscheduled

rate modifier. For example, an experience modifier, often used in commercial lines

of business, is modeled as an unscheduled rate modifier. This modifier has a minimum

value of -0.5 and a maximum value of 0.5.

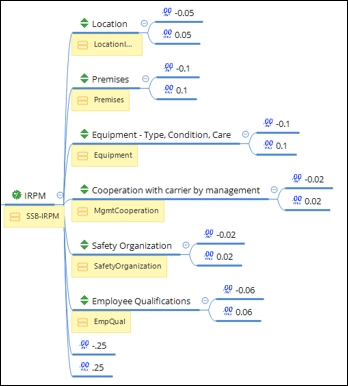

Scheduled rate modifier

Scheduled rate modifiers are often used in commercial lines of business, and include

multiple rate factors. For example, an Individual Risk Premium Modification (IRPM)

for a commercial property product has the following rate factors:

- Location (-0.05 to 0.05)

- Premises (-0.1 to 0.1)

- Equipment - Type, Condition, Care (-0.1 to 0.1)

- Cooperation with carrier by management (-0.02 to 0.02)

- Safety Organization (-0.02 to 0.02)

- Employee Qualifications (-0.06 to 0.06)